today announced the release of Banktivity 8.2, a new version of their money management app. Bonus: Portfolio Tracking - This may be a very specific feature for a very specific purpose, but for those looking to track the performance of their portfolio (stocks, bonds, etc.), it’d be great for the winning app to be able to handle this element of financial planning as well.Putney, Vermont – IGG Software, Inc.Some applications offer additional features, so you’ll have to weigh whether that additional functionality justifies the additional cost.

Price – While most personal finance apps are built on the same core principles, they are not all priced similarly.We try to take this into account when picking our recommended personal finance application. Some personal finance apps offer much better support in this area than others, but if you find yourself in a situation where you use a non-North American bank, your options might be limited. Accessibility – If you live outside the USA & Canada, there’s a pretty good chance your financial institution might not be supported.

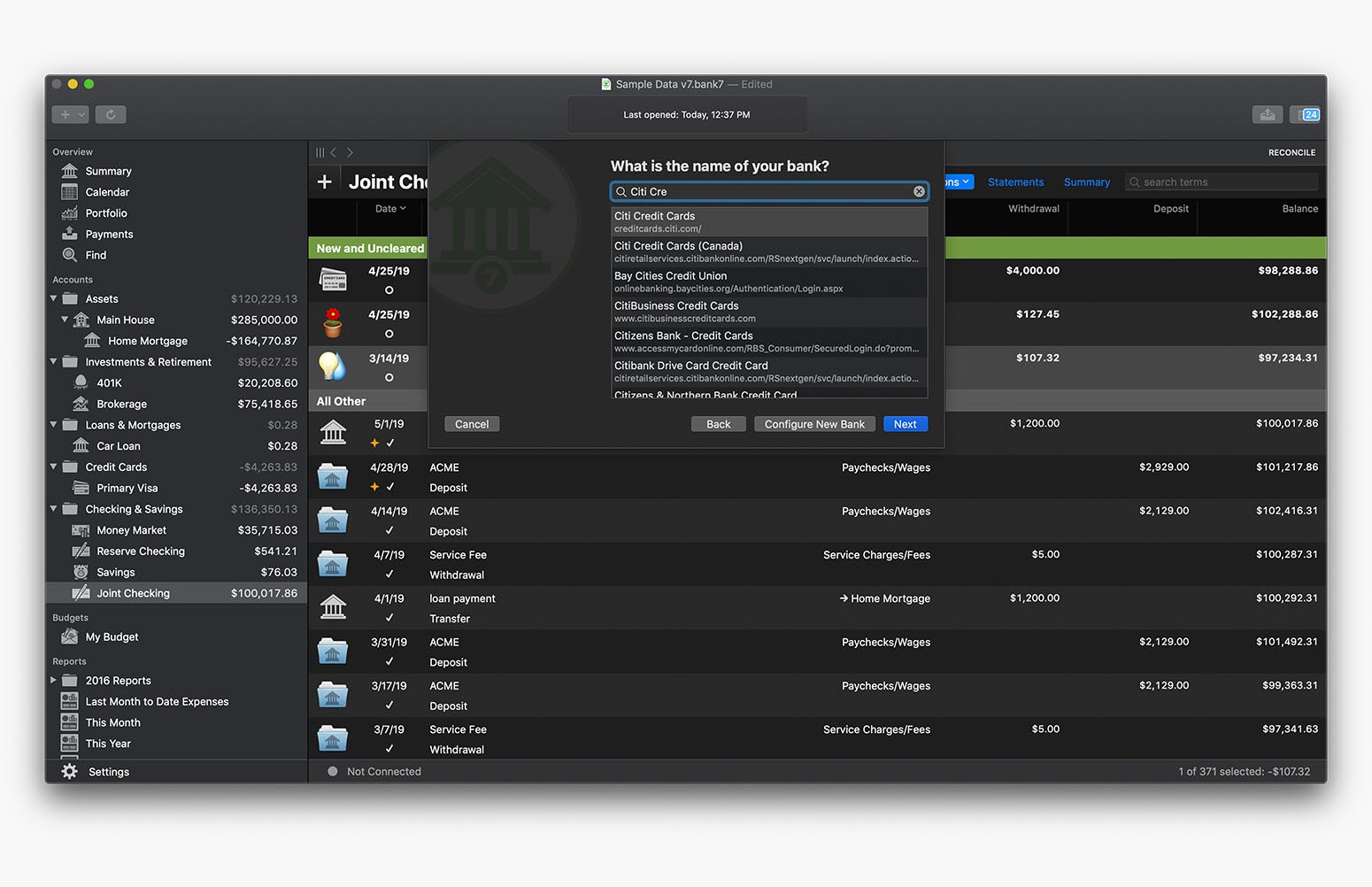

#REVIEW OF BANKTIVITY FOR MAC SOFTWARE#

Some services/apps take this a step further and also offer additional coaching/training options to not only support the software they develop, but also to educate their customers on basic money management and budgeting principles so they are ultimately more successful with their finances. Customer Support/Coaching – There is monetary value in having the peace of mind that comes with knowing that there is a friendly and helpful support staff ready to assist you if something breaks.These can be very useful, but also require a bit more understanding and add some complexity to the application (but when implemented correctly, it’s totally worth it). Goal Setting/Management Tools – Some personal finance apps have tools to help you go above and beyond basic budgeting needs and allow you to set and achieve financial goals.end-of-year reports and tracking spending over time) can be very useful in identifying spending habits, tracking investments, etc. Graphs and charts that display macro-level information (i.e. Reporting Options and Data Consumption – A very important aspect of personal finance management is being able to step back from the transaction level and look at the big picture.Since the right tool for the job is the one that you have with you, we also take into consideration the other platforms these tools exist on and the ease with which the data syncs between them. In fact, our survey showed that only 46% of respondents preferred to track expenses on their Mac. The Ecosystem – While this article is written through the lens of our favorite personal finance app for the Mac, we realize that not all financial management activity will take place there.We’ll try to take this into consideration and point it out where necessary.

Some apps are built around the philosophy of “feeling the pain” of every transaction. Some apps pull in all your transactions automatically, which makes it easier to reconcile your accounts and makes sure your information is current, but can also skim over the actual impact of your transactions.

0 kommentar(er)

0 kommentar(er)